What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, typically between 300 and 850, reflecting your financial behavior. It shows how likely you are to repay borrowed money such as car loan, credit card debt, mortgage loan. It’s used by lenders, landlords, insurance companies, and even employers to evaluate your financial behavior.

A poor credit score can lead to higher interest rates on loans and credit cards, which means you'll pay more for borrowed money over time. This can impact your overall quality of life by reducing your disposable income and limiting your financial flexibility.

By maintaining a good credit score, you can avoid potential pitfalls and enjoy more financial opportunities and better terms across various aspects of your life. Regularly monitoring your credit report, paying bills on time, and managing your debt responsibly are key steps to improving and maintaining a healthy credit score.

Unexpected Ways Your Credit Score Affects Your Life

These are a few unexpected results you get based on your credit score.

How can you build a better credit score?

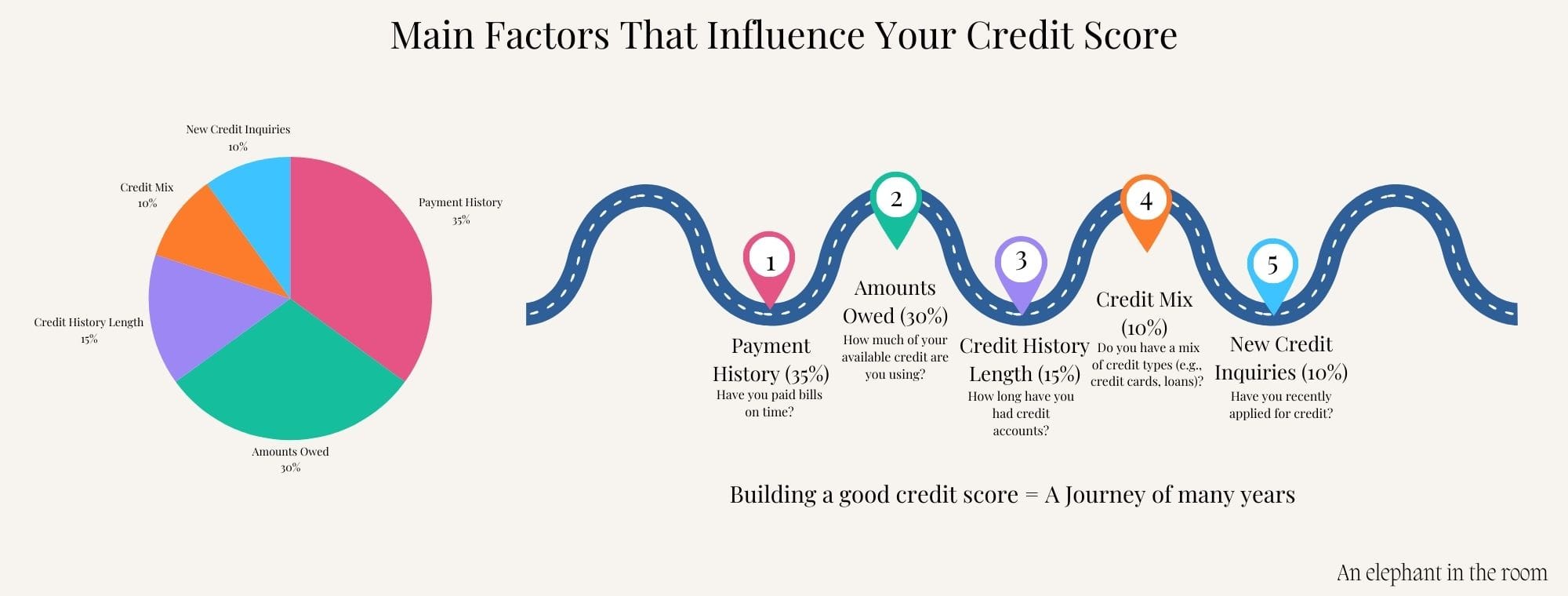

Building a better credit score takes time and consistent financial habits. Here’s a step-by-step guide to improve your credit score:

1. Pay Your Bills on Time

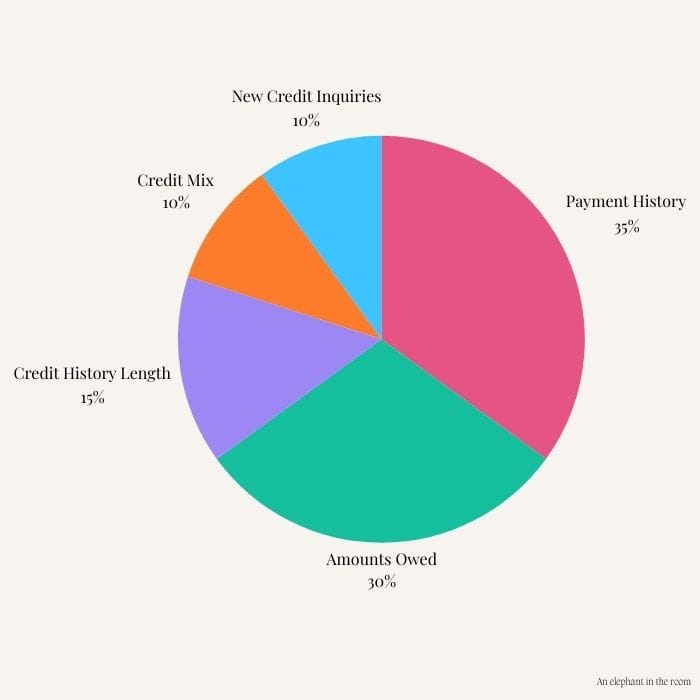

- Why it matters: Payment history is the largest factor in your credit score (35% in the FICO model).

- How to do it: Set up automatic payments or calendar reminders to avoid missing due dates.

2. Keep Credit Card Balances Low

- Why it matters: Credit utilization (the percentage of available credit you're using) accounts for 30% of your score.

- How to do it:

- Aim to use less than 30% of your total credit limit.

- Ideally, keep utilization below 10% for optimal scores.

3. Don’t Close Old Credit Accounts & Maintain Credit History

- Why it matters: The length of your credit history makes up 15% of your score.

- How to do it: Keep older accounts open, even if you don’t use them regularly, as they add to your credit history.

4. Avoid Applying for Too Much New Credit

- Why it matters: Each hard inquiry (when a lender checks your credit) can lower your score slightly.

- How to do it: Space out applications for credit and only apply when necessary.

5. Diversify Your Credit Mix

- Why it matters: Having different types of credit (e.g., credit cards, auto loans, mortgages) makes up 10% of your score.

- How to do it: If you only have credit cards, consider taking out a small installment loan (like a personal or car loan).

6. Dispute Errors on Your Credit Report

- Why it matters: Errors, such as incorrect late payments or accounts that aren’t yours, can unfairly lower your score.

- How to do it:

- Check your credit report regularly (you’re entitled to one free report per year from each bureau via AnnualCreditReport.com).

- Dispute inaccuracies directly with the credit bureau.

7. Pay Down Debt Strategically

- Why it matters: High balances on loans or credit cards can hurt your score.

- How to do it:

- Use the debt snowball method (paying off the smallest debts first) or the debt avalanche method (paying off high-interest debts first).

- Consider making extra payments to reduce your balances faster.

8. Use a Secured Credit Card if Necessary

- Why it matters: A secured card helps you build credit if you don’t qualify for traditional credit cards.

- How to do it: Deposit a certain amount as collateral, use the card responsibly, and pay off the balance monthly.

9. Become an Authorized User

- Why it matters: If someone with good credit adds you as an authorized user on their account, their positive credit behavior can benefit your score.

- How to do it: Ask a trusted family member or friend to add you to their account.

10. Monitor Your Progress

- Why it matters: Staying informed helps you catch issues early and maintain focus on your goals.

How to do it: Use apps or services like Credit Karma, Experian, or your bank’s credit monitoring tools to track your score regularly.